Enterprise reporter, BBC Information

Getty Photographs

Getty PhotographsUK authorities borrowing rose by greater than anticipated final month, including to the strain on the Chancellor, Rachel Reeves.

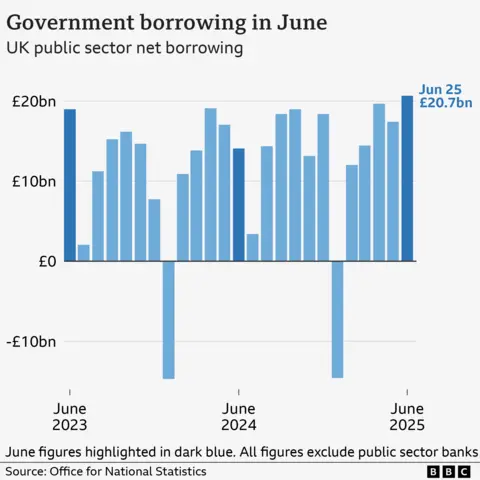

Borrowing – the distinction between public spending and tax revenue – was £20.7bn in June, up £6.6bn from the identical month final yr, the Workplace for Nationwide Statistics (ONS) mentioned.

Larger spending on public companies and debt curiosity funds outstripped income from different taxes, together with employers’ Nationwide Insurance coverage contributions which was lifted in April, the ONS mentioned.

Analysts say it’s more and more doubtless that the chancellor should elevate taxes on the Finances within the autumn, after the federal government reversed cuts to advantages that had been aimed toward saving billions of kilos.

The most recent borrowing determine was the second-highest June determine since month-to-month data started in 1993, the ONS added, behind solely June 2020, which was closely affected by the pandemic.

Dennis Tatarkov, senior economist at KPMG UK, mentioned the information “piles extra strain on public funds”.

“Moreover, the longer-term outlook for public funds stays troublesome. Current U-turns on welfare and protracted development headwinds may open a niche towards fiscal targets, which may require additional tax rises or spending cuts within the Autumn Finances.”

The ONS mentioned curiosity funds on authorities debt rose to £16.4bn in June 2025, which was practically double the quantity paid on the similar level final yr.

The rise is because of a pick-up within the charge of inflation, with curiosity funds on some authorities debt linked to the Retail Costs Index measure of inflation.

Borrowing within the first three months of the present monetary yr has now reached £57.8bn. Whereas this is a rise of £7.5bn from the identical interval in 2024, it’s in step with what the Workplace for Finances Accountability, the official impartial forecaster, had predicted.

Regardless of this, Alex Kerr, UK economist at Capital Economics, warned that “issues will in all probability worsen for the chancellor”.

“We expect that she might want to elevate £15-25bn on the Finances later this yr, with larger taxes doing a lot of the heavy lifting.”

Mr Kerr added that the ONS figures urged “the latest weak point within the labour market is weighing on [tax] receipts”, and this might proceed “with underlying financial development nonetheless weak”.

The newest development figures have proven that the UK’s financial system contracted in both April and May.

Final month Reeves refused to rule out tax increases.

There was hypothesis that the freeze on revenue tax thresholds, which is because of finish in 2028, could possibly be prolonged. The freeze implies that, over time, extra individuals are dragged into paying larger tax charges.

The chancellor is following two major guidelines for presidency funds:

- day-to-day authorities prices shall be paid for by tax revenue, somewhat than borrowing

- to get debt falling as a share of nationwide revenue by the top of this parliament in 2029-30

Talking to the Financial Affairs Committee within the Home of Lords, Reeves mentioned sticking to those fiscal guidelines was “non-negotiable”, as they supplied stability to the financial system and gave “authorities bondholders the arrogance to hold on shopping for these bonds”.

“We’re nonetheless very reliant on the goodwill of strangers in shopping for our authorities bonds,” she mentioned, echoing comparable feedback made by Mark Carney, the previous Financial institution of England governor who’s now the prime minister of Canada.

“I’ll stick with these fiscal guidelines so we are able to carry down the price of servicing that debt,” she added.

Reeves additionally defended the choice to extend Nationwide Insurance coverage Contributions for companies, a coverage that has been criticised by many companies.

She mentioned the cash raised from such tax will increase “put our public funds on a agency footing, and in addition enabled us to place that extra cash, £29bn further a yr into the Nationwide Well being Service. So that they had been the suitable choices within the circumstances.”

Reacting to the newest borrowing figures, shadow chancellor Mel Stride mentioned: “Rachel Reeves is spending cash she does not have. Debt curiosity already prices taxpayers £100bn a yr – virtually double the defence finances.”