Information Americas, DAVOS, Switzerland, Weds. Jan. 21, 2026: Whereas international headlines body one Caribbean territory’s newest transfer as a daring “crypto guess,” the island’s actual play is way extra pragmatic – and much more Caribbean.

Bermuda, a British abroad territory, isn’t chasing crypto tradition. It’s attempting to flee the quiet tax that small island economies pay each day: punitive banking prices, sluggish cross-border funds, and shrinking service provider margins.

On the World Financial Discussion board this week, Bermuda introduced plans to turn out to be the world’s first absolutely on-chain nationwide financial system, partnering with Circle and Coinbase. However beneath the buzzwords lies a well-known Caribbean downside – and a strategic response different territories are watching intently.

For many years, Caribbean jurisdictions have been lumped into “high-risk” banking classes, no matter compliance power. The outcome:

- Increased service provider charges

- Delayed settlements

- Restricted entry to worldwide cost processors

- and fixed de-risking stress on native banks

For small and medium-sized companies, particularly in tourism and providers, conventional cost rails quietly drain income. Bermuda’s transfer to an on-chain financial system utilizing USDC isn’t about changing the greenback -— it’s about accessing it extra effectively.

With stablecoin funds, Bermudian retailers can settle for quick, dollar-denominated transactions with out the layers of correspondent banking charges which have lengthy punished island economies merely for being islands.

What makes Bermuda totally different isn’t the know-how – it’s the groundwork.

The territory has spent practically a decade constructing regulatory credibility, changing into one of many first jurisdictions globally to implement a complete digital asset framework underneath its Digital Asset Enterprise Act in 2018. Circle and Coinbase have been early licensees, rising alongside the island’s regulated ecosystem. That regulatory maturity is why Bermuda can experiment at a nationwide scale whereas many Caribbean governments stay caught between concern of de-risking and concern of innovation.

The current USDC airdrop on the Bermuda Digital Finance Discussion board – 100 USDC to each attendee to be used at native retailers – wasn’t a gimmick. It was a reside stress check of whether or not digital finance may flow into worth regionally, not siphon it offshore.

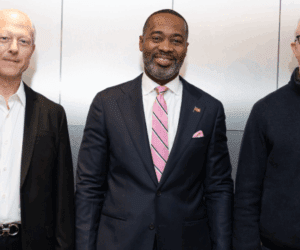

Premier David Burt has framed the initiative as a collaboration between authorities, regulators, and business – a mannequin that displays Bermuda’s long-standing method to monetary providers. “Bermuda has all the time believed that accountable innovation is finest achieved via partnership between authorities, regulators, and business,” mentioned Premier Burt. “With the help of Circle and Coinbase, two of the world’s most trusted digital finance firms, we’re accelerating our imaginative and prescient to allow digital finance on the nationwide degree. This initiative is about creating alternative, reducing prices, and making certain Bermudians profit from the way forward for finance.”

“Bermuda has been a worldwide pioneer in digital asset regulation and continues to show what accountable blockchain innovation seems like at a nationwide scale,” mentioned Circle Co-Founder, Chairman, and CEO, Jeremy Allaire. “We’re proud to deepen our engagement as Bermuda empowers individuals and companies with USDC and onchain infrastructure.”

“Coinbase has lengthy believed that open monetary methods can drive financial freedom,” mentioned Coinbase CEO Brian Armstrong. “Bermuda’s management exhibits what is feasible when clear guidelines are paired with sturdy public-private collaboration. We’re excited to help Bermuda’s transition towards an onchain financial system that empowers native companies, customers, and establishments.”

If profitable, Bermuda’s experiment may supply a blueprint for different Caribbean territories grappling with the identical structural constraints however missing Bermuda’s regulatory head begin. The actual query isn’t whether or not crypto works. It’s whether or not on-chain finance can lastly degree a worldwide system that has by no means been honest to small island economies.

For the Caribbean, Bermuda’s guess could sign not a leap into the longer term – however a long-overdue correction of the previous.

Source link