By Darshand Khusial

Information Americas, NEW YORK, NY, Mon. Feb. 17, 2025: The U.S. Foreign Tax Credit, (FTC), is designed to stop double taxation by permitting people and firms to offset taxes paid to international governments towards their U.S. tax obligations. Nonetheless, there may be compelling proof that ExxonMobil and its associates get hold of tax certificates issued by the Guyana Income Authority (GRA) with out really paying taxes in Guyana. The Oil and Gasoline Governance Community Guyana (OGGN) suspects that these tax certificates could also be used to assert illegitimate FTCs from the U.S. Inner Income Service (IRS), probably depriving the U.S. Treasury of billions of {dollars} in tax revenues.

Guyana’s Taxation Association with ExxonMobil

Below the 2016 Petroleum Agreement (PA) between the Authorities of Guyana and ExxonMobil Guyana Restricted (EMGL), a subsidiary of ExxonMobil, Hess Company, and China Nationwide Offshore Oil Firm (CNOOC), the federal government agreed to pay the oil corporations’ taxes from Guyana’s share of oil income. Particularly:

• Article 15.4 of the PA states that the Minister answerable for Petroleum can pay taxes on behalf of the Contractor (ExxonMobil and associates) and that this sum might be thought of the Contractor’s revenue.

• Article 15.5 specifies that the Minister will be certain that the GRA points tax receipts and certificates confirming these funds.

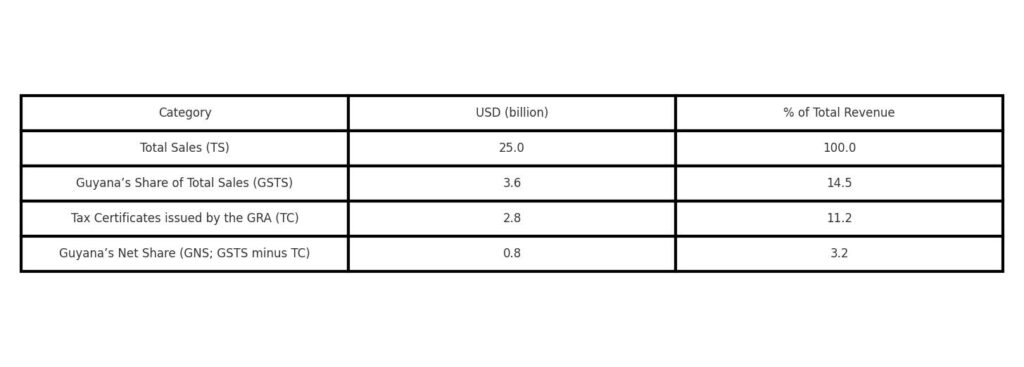

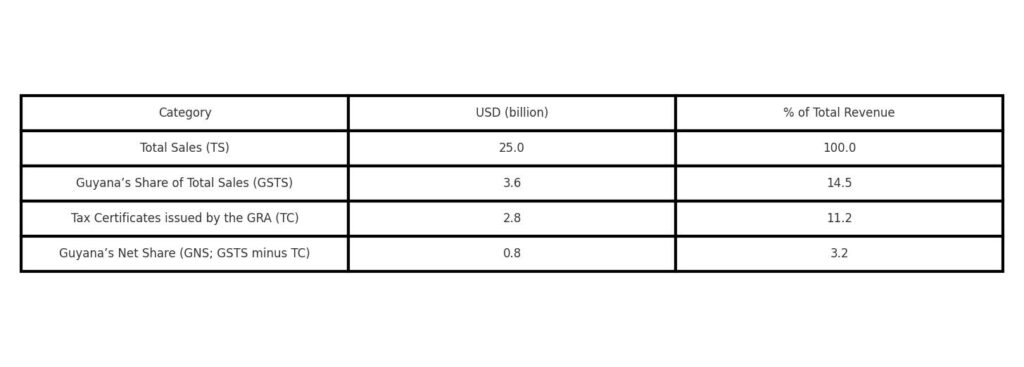

In consequence, fairly than paying company revenue taxes straight, ExxonMobil and its associates, profit from Guyana’s tax funds, amounting to Tax Certificates issued to the worth of roughly USD 2.8 billion from 2020 to 2023 (Desk 1; tailored from Ref. 3, 1 USD = 208.5 GYD). This follow signifies that 78% of Guyana’s complete oil revenues (USD 3.6 billion) had been earmarked to cowl taxes on behalf of international firms. This leaves Guyana’s web share of complete oil gross sales in actual phrases at a meager USD 0.8 billion (3.2% of Complete Oil Income).

Guyana’s Internet Share of Complete Oil Gross sales, 2020 to 2023

Authorized and Monetary Issues

The central difficulty is whether or not ExxonMobil and its associates use these tax certificates to assert U.S. FTCs with out really paying international taxes. In that case, this follow might violate U.S. tax legal guidelines, notably:

• 26 U.S. Code §901: Credit score for taxes paid to international international locations – This provision requires that international taxes be “really paid or accrued” to qualify for U.S. tax credit.

• IRS rules on financial substance (26 U.S. Code §701(o)) – Transactions will need to have financial substance past tax advantages.

Provided that ExxonMobil and its associates do in impact not remit taxes to the Guyanese authorities, their means to assert FTCs below these statutes is extremely questionable.

It might be argued that the tax association is authorized below Guyana’s 2016 PA and that it’s commonplace follow within the oil and fuel trade. Nonetheless, the IRS has strict tips requiring that tax funds be precise and obligatory, fairly than merely recorded in agreements. Moreover, there are not any public data confirming that the Authorities of Guyana has remitted these tax funds to the GRA, making the tax certificates issued to ExxonMobil and its associates probably deceptive.

Conclusions and suggestions

The tax association for ExxonMobil and its associates as outlined within the 2016 PA is an outlier; different corporations in Guyana don’t obtain related advantages. Given these details, OGGN, a registered 501(c)(3) non-profit group in New York, United States, urges the US authorities to:

- Provoke a proper investigation into ExxonMobil’s use of tax certificates issued below Guyana’s 2016 PA.

- Request IRS overview of whether or not ExxonMobil’s claimed FTCs adjust to U.S. tax legal guidelines.

- Maintain hearings or introduce laws to stop related preparations from depriving the U.S. Treasury of income sooner or later.

The potential loss to U.S. taxpayers over the 40-year period of the PA might quantity to tens of billions of {dollars}. Making certain tax equity is important to upholding transparency and company accountability.

EDITOR’S NOTE: This text represents the opinion of OGGN solely and never Information Americas. It was written by Darshanand Khusial with contributions from Andre Brandli, Kenrick Hunte, Alfred Bhulai, Janette Bulkan and Joe Persaud for the Oil & Gas Governance Network Guyana (OGGN)

Source link